From the outside, the electric vehicle story looks clean and linear. Adoption is rising. Infrastructure is expanding. Automakers are investing billions. Government incentives are in place. On paper, the future of mobility appears inevitable.

But beneath that narrative sits a quieter truth that most auto executives haven’t fully grappled with: the consumers who will ultimately determine the success of the EV transition, namely Black, Hispanic, and multicultural buyers, are interested, engaged, and paying attention, yet remain significantly underrepresented in actual EV purchases. That gap isn’t about desire. It’s about access, trust, and a market still designed around assumptions that no longer hold.

Interest in EVs among Black and multicultural consumers is not marginal. It is meaningful and, in some cases, higher than among white consumers. National survey data show that Black Americans are just as likely, and sometimes more likely, to say they would seriously consider an EV. Latino consumers express even higher interest. Asian Americans lead overall consideration. These are not fringe audiences testing the edges of the category; they are central to its future.

And yet, when you look at who is actually buying EVs, the picture shifts dramatically. Black and Hispanic consumers account for a significant share of gasoline vehicle purchases but represent a fraction of EV buyers. The result is a contradiction that should concern any automaker serious about long-term growth: enthusiasm exists, but conversion does not. That is not a marketing failure alone. It’s a systems failure.

The EV market has largely been built for consumers with specific advantages: homeownership, private garages, disposable income, proximity to charging infrastructure, and long-standing trust in automotive retail environments. Many Black and multicultural consumers operate outside of that default. Urban density, multi-unit housing, longer financing considerations, and historical inequities in infrastructure distribution all shape whether an EV feels aspirational or impractical.

Charging access is one of the most visible fault lines. In many majority-Black and majority-Hispanic neighborhoods, public charging stations are fewer and farther between, even when income levels are comparable. For consumers who cannot install home chargers, this isn’t an inconvenience—it’s a dealbreaker. An EV without reliable, nearby charging is not freedom; it’s friction. When brands promote an electrified future without addressing this reality, the message received is simple: this future wasn’t built with you in mind.

Cost concerns compound the issue. While the total cost of ownership for EVs can be lower over time, upfront pricing, financing terms, and uncertainty around maintenance and resale value still loom large for buyers who have historically had less margin for error in major purchases. These concerns are rational, not resistant. Yet too often, they are dismissed as a lack of education rather than recognized as signals of where the market must adapt.

Then there’s the retail experience itself. Multicultural consumers tend to enter the auto purchase journey with lower brand awareness but higher openness. They consider more brands, spend more time researching, and are more influenced along the way. In theory, this should make them ideal EV customers: curious, flexible, and willing to explore something new. In practice, many encounter dealerships unprepared to address their questions, their realities, or their skepticism. Representation among dealership ownership and sales leadership remains disproportionately low, reinforcing a sense that EVs, and the industry selling them, belong to someone else.

What’s striking is that none of this suggests a lack of ambition or aspiration among Black and multicultural buyers. Quite the opposite. These consumers are often younger, more urban, and more attuned to the cultural and economic shifts shaping transportation. They are thinking about fuel costs, environmental impact, and the future their families will inherit. The issue is not whether they want to participate in the EV transition. It’s whether the EV transition has made room for them.

Auto brands, however, continue to rely on a familiar playbook. EV marketing still leans heavily on product specs, performance metrics, and broad environmental messaging. While those elements matter, they do little to address the lived realities that determine whether an EV fits into someone’s life. Range anxiety isn’t just about miles; it’s about where you live. Sustainability messaging rings hollow if you watch the infrastructure bypassing your neighborhood. Innovation feels distant if the buying experience feels exclusionary.

The consequence of ignoring these nuances is not only slower adoption among certain groups, but also a lack of understanding of the broader implications. It’s missed loyalty. Multicultural consumers represent one of the most dynamic growth engines in the U.S. auto market. They are shaping demand now, not later. Brands that fail to engage them meaningfully during this transition risk losing relevance not just in EVs, but across their portfolios.

The EV shift is often framed as a technological evolution, but the data suggests it is equally a cultural one. Technology can be engineered. Culture must be understood. Without that understanding, even the most advanced vehicles will struggle to gain traction where it matters most.

If automakers want EV adoption to scale equitably and profitably, they must move beyond assuming interest equals access. They must invest in infrastructure where people actually live, rethink how EV ownership is explained and supported, and treat multicultural insight as core business intelligence rather than a secondary consideration. The brands that do this will not only close the adoption gap; they will build trust at a moment when trust is becoming one of the industry’s most valuable currencies.

Because the future of mobility isn’t just electric. It’s multicultural. And the brands that recognize that now will define what comes next.

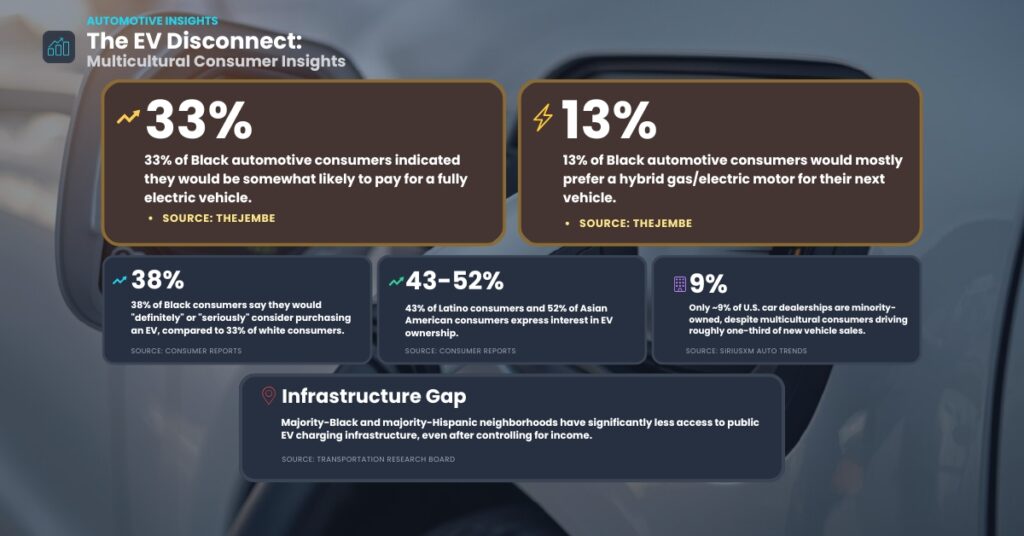

In a recent survey of Black automotive consumers, 33% of respondents indicated they would be somewhat likely to pay for a fully electric vehicle. Source: TheJembe

38% of Black consumers say they would “definitely” or “seriously” consider purchasing an EV, compared to 33% of white consumers. Source: Consumer Reports

43% of Latino consumers and 52% of Asian American consumers express interest in EV ownership. Source: Consumer Reports

13% of Black automotive consumers would mostly prefer a hybrid gas/electric motor for their next vehicle. Source: TheJembe

Majority-Black and majority-Hispanic neighborhoods have significantly less access to public EV charging infrastructure, even after controlling for income. Source: Transportation Research Board

Only ~9% of U.S. car dealerships are minority-owned, despite multicultural consumers driving roughly one-third of new vehicle sales. Source: SiriusXM Auto Trends/industry reporting