Insurance has always sold itself as certainty. A promise that when the unexpected arrives, someone has your back. But in 2025, the industry is discovering an uncomfortable truth: certainty doesn’t sell if trust isn’t there. And trust is no longer built on price, convenience, or even legacy. It’s built on culture. Consumers aren’t just evaluating the product; they’re scanning for signs that the brand understands their lived experience. This is why cultural fluency has become the new premium; the value customers assign to a brand that doesn’t just ensure their future but recognizes their reality.

The trust gap emerging across the insurance landscape is not theoretical. It’s quantifiable. According to a 2024 cross-population study, minority and underrepresented groups are significantly less likely to view insurance agents as trustworthy sources of information. Only about 29% of Hispanic and Black respondents cited agents as a primary resource, compared to over 40% of non-Hispanic Asian and white consumers. What this reveals isn’t simply a different channel preference; it’s a different trust framework altogether.

Traditional gatekeepers of insurance information lack cultural resonance for large portions of the population, and consumers are building their financial knowledge elsewhere. The American College of Financial Services found that just one in three consumers expresses high trust in financial services, and even among those who do, 60% say clear, easy-to-understand products matter more than low fees or strong guarantees. When clarity carries more weight than cost, communication becomes cultural.

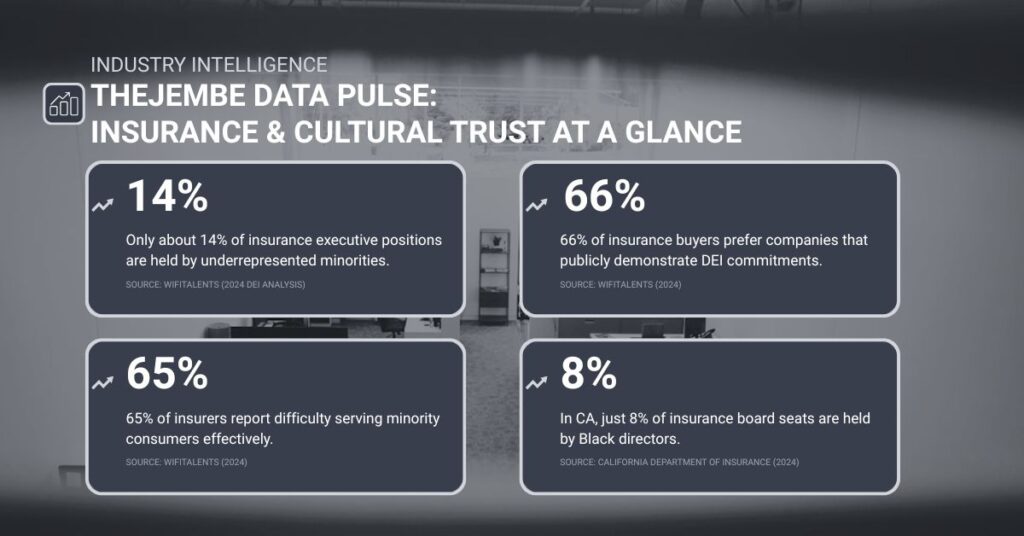

These numbers form a picture that the industry can no longer ignore. Multicultural consumers are not niche segments; they are the (very near) future majority. Yet the industry serving them still looks, operates, and communicates like a legacy institution built for a different America. When gaps show up in leadership, policy design, claims, and communication, those gaps don’t remain internal; they become public-facing trust fractures.

Insurers often present inclusion through messaging long before they integrate it into their systems. California’s Department of Insurance notes that while women now hold over 25% of board seats across insurance companies in the state, racial and ethnic diversity remains disproportionately low, especially among Latino, Black, and Indigenous directors—representation matters, not as optics but as operational credibility.

When the people who make decisions about coverage, risk modeling, and product development don’t reflect the communities they’re trying to serve, the products themselves often carry cultural blind spots. The industry’s own data admits this: only about 20% of policies explicitly address issues tied to race, ethnicity, or gender. This isn’t about political correctness. It’s about product relevancy.

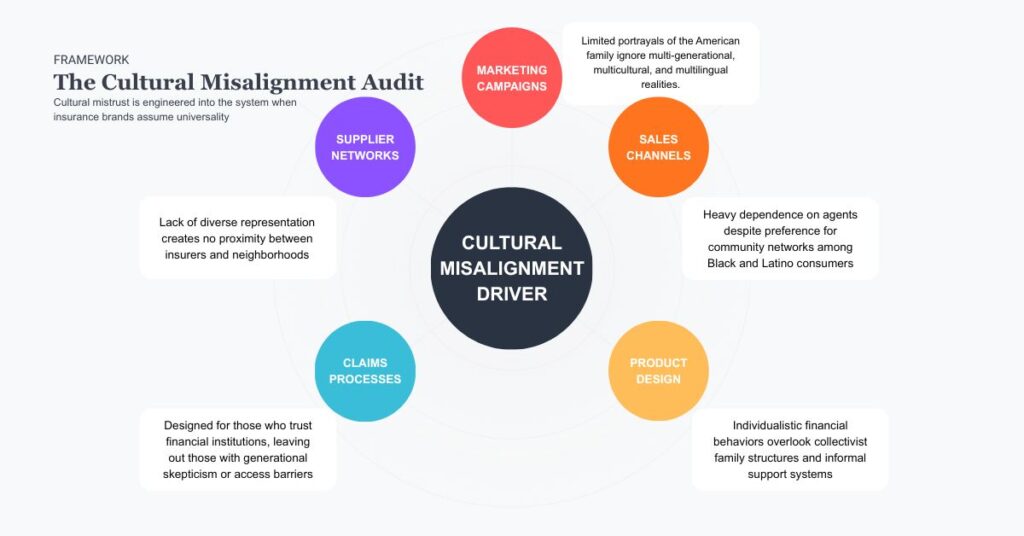

Cultural mistrust doesn’t appear out of thin air; it’s engineered into the system when insurance brands assume universality. Many marketing campaigns still rely on narrow portrayals of “the American family,” missing the multi-generational, multicultural, and multilingual reality that shapes much of the country. Sales channels often depend heavily on agents despite clear evidence that many communities– especially Black and Latino consumers– prefer to consult community networks, peer groups, or independent advisors instead.

Product designers sometimes build offerings around individualistic financial behaviors, overlooking collectivist family structures or informal support systems that change how people perceive and manage risk. Claims processes are typically designed for consumers who already trust financial institutions and have digital access, leaving out those who hold generational skepticism or face barriers to navigation. Even supplier networks, which play a quiet but powerful role in economic credibility, often lack diverse representation. When communities see no proximity between insurers and the economic life of their neighborhoods, trust becomes tenuous.

The cost of cultural misalignment is measurable in consumer behavior. When marketing doesn’t resonate, customers disengage. When sales channels feel foreign or unrelatable, they are bypassed. When claims processes feel inaccessible or dismissive, they become narrative landmarks, stories that travel within communities and define brand perception long after a claim is closed. Research underscores this point: underserved groups are far more likely to rely on “unofficial” information ecosystems, precisely because official ones have failed them.

Yet when insurers invest in cultural fluency, the effect is transformative. A recent report found that Black consumers are significantly more likely than other groups to express interest in wealth-protection and life insurance products — and that they place heightened value on a brand’s trustworthiness and commitment to equity. This is not simply a market niche; it’s a high-intent customer segment that responds directly to cultural respect. California’s supplier diversity results, over $3.1 billion spent with diverse businesses in 2023, also reveal a critical truth: when insurers build economic inclusion into their operational framework, they don’t just comply with guidelines. They build the kind of trust that money can’t buy, but investment can.

Cultural fluency has become a competitive advantage. It shows up in whether consumers feel welcome, seen, and respected. It shows up in whether product explanations feel like plain language or coded exclusion. It shows up in the difference between a claims experience that feels like friction and one that feels like dignity. It shows up when communication reflects cultural nuance, not translation, but understanding. And it shows up in measurable outcomes: better retention, higher product uptake, and stronger long-term loyalty.

What the insurance industry must confront is that culture is not a marketing layer; it’s infrastructure. It determines how risk is perceived, how information is trusted, and how value is assigned. Products that fail to acknowledge cultural realities lose relevance before they even reach the market. And in a category where trust determines survival, irrelevance isn’t a minor risk; it’s a structural failure.

The insurers that will lead the next decade will be the ones who treat cultural fluency not as a DEI initiative or campaign theme, but as a strategic operating principle. They will design products informed by real community behavior, build communication frameworks grounded in clarity rather than jargon, and develop leadership structures that reflect the full demographic spectrum of the country they serve. They will treat diversity as capability, not compliance. And they will understand that the future of insurance will be written by the brands that understand the cultures shaping the consumers they hope to protect.

Cultural fluency is the new premium. Consumers are already assigning value to it. The only question left is whether the industry is ready to meet the moment or be eclipsed by brands that do.